NYC-based insurtech firm Indemn has successfully raised $1.9 million in pre-seed funding, led by Markd and featuring participation from Afterwork Ventures, Everywhere Ventures, and other notable contributors. The funds will be instrumental in propelling Indemn’s vision to revolutionize the insurance acquisition experience through its AI-powered conversational insurance platform.

Established in 2021, Indemn has emerged as a pioneer in the insurtech space, aiming to reshape the way people learn about and purchase insurance coverage through natural conversations facilitated by artificial intelligence (AI) agents. The company, led by CEO Kyle Geoghan, plans to utilize the newly secured funds to expedite its growth in delivering innovative insurance products seamlessly integrated with AI-driven interactions.

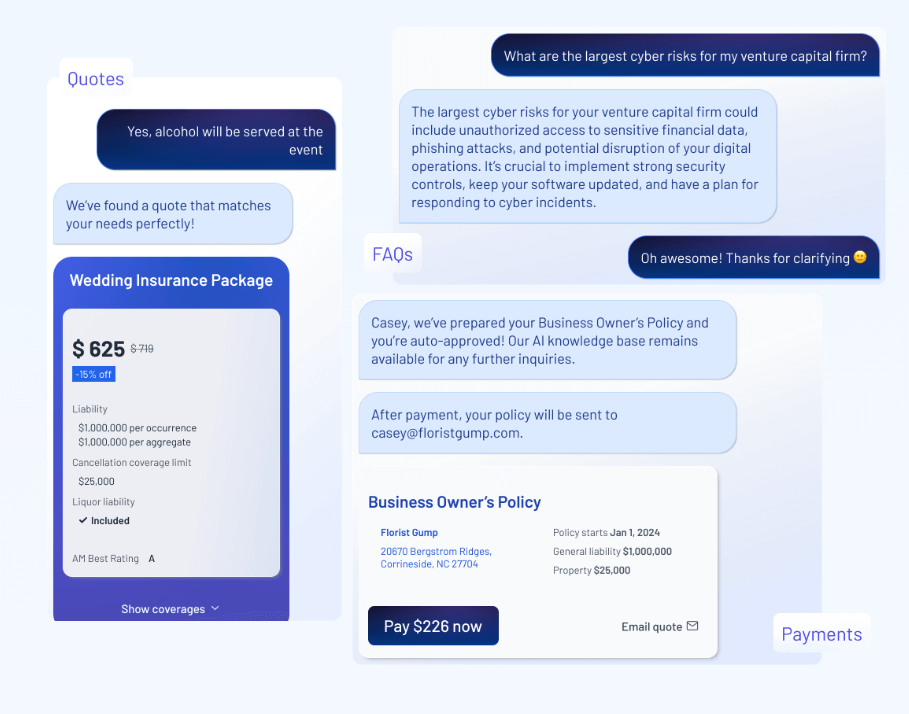

Indemn’s platform, built around Large Language Models (LLMs), introduces a transformative customer experience by providing information, product configuration, and underwriting through natural conversations. From quoting to purchase, the platform’s AI agents support all aspects of digital insurance, driving growth and reducing operational costs across distribution channels.

Kyle Geoghan, expressing enthusiasm about the funding, remarked, “We’re thrilled with the initial funding and support from investors who believe in our vision to transform the insurance acquisition experience with Large Language Models. Creating a better way for people to interact with insurance has been a long time coming, and we couldn’t be more excited to continue building the solution.”

Parker Beauchamp, Managing Partner at Markd, emphasized Indemn’s potential to revolutionize online insurance purchases, citing the team’s early adoption of generative AI and their deep understanding of insurance challenges. He stated, “The Indemn team, with its innovative product and early adoption of generative AI, is poised to improve the way insurance is purchased online.”

Indemn’s approach to insurance distribution aligns with its commitment to supporting existing channels. Their platform seamlessly connects users to AI agents and, when desired, to human agents supported by an AI-powered Copilot, ensuring a holistic and customer-centric experience.

The insurtech company’s focus on operational efficiency, reduction of costs, and enhancement of customer service positions them as a trailblazer in the insurtech landscape. With a blend of AI-powered conversations and human-agent support, Indemn is set to redefine the insurance industry, simplifying the buying process and charting a new course for insurance engagement.

For more information on Indemn and to experience the future of insurance, visit Indemn’s official website.

Leave a Reply