In a significant move that underscores the growing prominence of AI-powered direct indexing platforms for Registered Investment Advisors (RIAs), Alphathena has successfully secured a $4 million strategic investment. The funding round, led by ETFS Capital with participation from Hyde Park Angels, positions Alphathena to accelerate its mission of democratizing access to personalized direct indexing solutions for financial advisors.

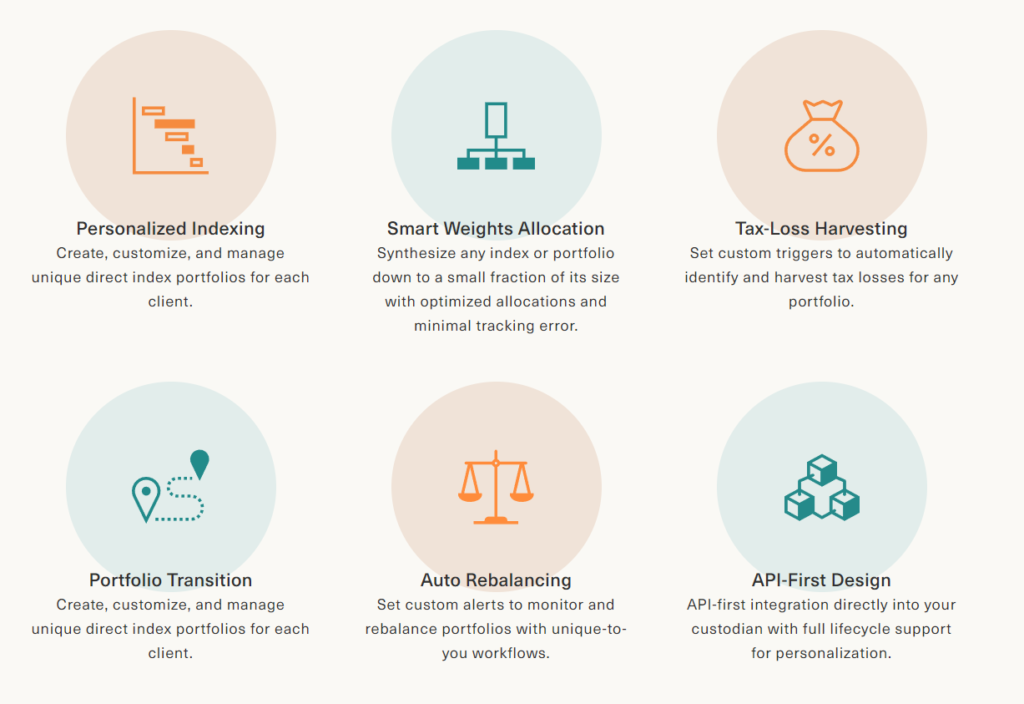

Founded in 2020 by Mohan Naidu and Tushad Driver, Alphathena has emerged as a leader in the industry, winning the Morningstar Fintech Showcase 2023 “Best in Show” award. The platform offers a range of features, including customization, direct indexing, automated tax-loss harvesting, optimized allocations, rules-based rebalancing, and portfolio transition tools. These tools are accessible through web solutions and an open API, enabling seamless integration for WealthTech partners.

The strategic investment comes at a crucial time, with financial advisors increasingly seeking personalized strategies like direct indexing and tax-loss harvesting for their clients. Alphathena’s AI-driven software provides a user-friendly interface and powerful investment tools, allowing RIAs to differentiate themselves in a competitive market while meeting the evolving needs of their clients.

Mohan Naidu, the founder of Alphathena, expressed gratitude for the support from ETFS Capital and HPA, stating, “Their belief in our platform and the future of direct indexing and personalization validates our vision of democratizing access to this powerful investment strategy for advisors of all sizes.”

Martyn James of ETFS Capital praised Alphathena’s innovative solution, emphasizing its potential to revolutionize how advisors manage portfolios. The platform’s unique approach focuses on custom indexing, enabling clients to build and optimize investment strategies tailored to their individual needs at scale.

As part of the investment, Mark Weeks of ETFS Capital and John Crosson of HPA will join Alphathena’s Board of Directors, bringing their expertise to support the company’s growth plans.

Looking ahead, Alphathena is committed to advancing product development while expanding its reach to independent advisors and growing firms. To further educate the industry, founders Mohan Naidu and Tushad Driver will host a webinar on February 8 at 2 p.m. EST, exploring the evolution of direct indexing in the financial services sector. Interested parties can register for the free event on the Alphathena website.

Check out the official notification about the funding here. For more information about Alphathena and to schedule a demo, visit Alphathena’s website.

Leave a Reply