Institutional investors are increasingly placing their bets on the transformative power of artificial intelligence (AI) in trading, according to the latest survey conducted by multinational investment bank JPMorgan. The survey, titled “e-Trading Edit: Insights from the Inside,” encompassed 4,010 institutional traders across 65 countries.

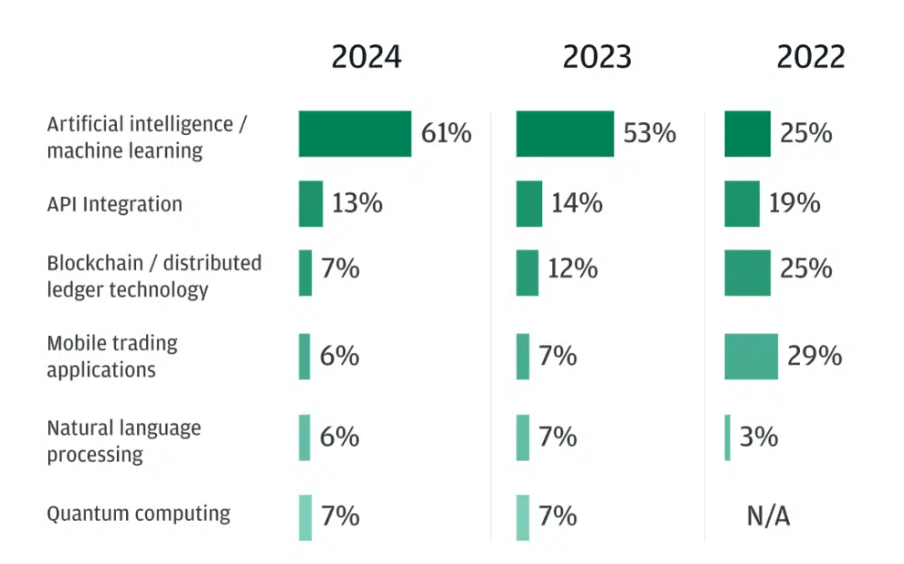

A striking 61% of respondents indicated that they believe AI and machine learning (ML) will be the most impactful technologies shaping the future of trading within the next three years. This marks a significant uptick from previous years, reflecting a growing confidence in AI’s ability to revolutionize trading practices.

Interestingly, blockchain technology, once hailed as a promising asset, has seen a dramatic decline in confidence among institutional traders. Merely 7% of respondents expressed belief in blockchain’s prospects over the next three years, representing a staggering 72% decrease from 2022. Despite this decline, blockchain still holds the third position in terms of prospects, following API integration (13%) and AI/ML.

The survey also shed light on institutional traders’ sentiments towards cryptocurrency trading. A notable 78% of respondents stated that they have no plans to engage in digital asset trading, reflecting a prevailing skepticism towards cryptocurrencies such as Bitcoin. However, there has been a slight uptick in crypto trading activity, with 9% of respondents already involved in the market, and 12% considering entry within the next five years.

This shift in sentiment towards blockchain and crypto aligns with broader market trends. According to data from Galaxy Digital, both blockchain and crypto markets experienced a downturn in Q3 2023, with a decline in completed deals and total capital invested. Despite these challenges, there are signs of resilience in the venture capital landscape, with a modest increase in fundraising and new fund launches.

JPMorgan’s stance on cryptocurrencies, notably Bitcoin, has been contentious in recent years. CEO Jamie Dimon has been vocal in his criticism of digital assets, despite the company’s involvement in Bitcoin-related initiatives. The survey results underscore the cautious approach taken by institutional investors towards emerging technologies, highlighting the evolving dynamics within the financial sector.

Leave a Reply